The Emerging Shape of Fintech’s AI-Native Winners

This era of fintech isn’t a remodel , it’s a teardown

By Lauren Kolodny, Co-founder & Managing Partner, Acrew Capital

Let’s be honest: financial services has been stubbornly resistant to fundamental change.

Don’t get me wrong, the past decade of fintech has been critical for the industry: it has expanded access, improved distribution, and modernized the customer experience. At Acrew, we’ve been lucky to back some of the generational companies that have led that charge–and paving the way for what comes next.

But AI has the potential to upend the structural blueprint of financial services.

This isn’t about squeezing more efficiency out of existing systems. AI redefines the architecture altogether–introducing new actors (agents), new primitives (intent, delegation, autonomous execution), and new threat vectors (synthetic identity, deepfake fraud). Its very existence poses an existential threat to an industry that has been inching slowly toward “digital transformation” — demanding swift substantial change or risking obsolescence.

And what’s different this time is agency.

Unlike past cycles, the AI-native opportunity doesn’t start with better tooling — it starts with a shift in agency itself. Agents don’t just assist; they act. And when software starts behaving like a user, the entire stack — including some of the very financial products themselves — breaks and needs to be rebuilt.

So where do AI-native entrants win?

The shape of reinvention will be more profound–and less predictable–than any tech before

Unlike prior tech shifts, like mobile or cloud, the shape of this transformation isn’t as clear.

In cloud, new entrants had a clear edge — born flexible, built to scale.

In mobile, native players redefined industries using location and real-time UX.

In AI, it’s murkier. The tech is easy to deploy. Large incumbents have an edge in data and distribution.

Moats blur.

And many financial services leaders do recognize the opportunity and existential threat of AI. Nearly half say legacy tech is hurting resilience.¹ And with the global fintech AI market projected to reach $80B by 2030², the imperative couldn’t be more clear: evolve or become irrelevant.

What the Acrew x Money20/20 AI Index Revealed: industry leaders are adopting AI at staggering rates and in meaningful ways

In order to get better visibility into what financial services industry leaders are actually doing with AI, we at Acrew launched the All in on AI: Financial Services AI Adoption Index alongside Money20/20 last fall. After studying 200+ leading fintechs and financial institutions, here’s what surprised us:

76% announced a meaningful AI initiative — staggering adoption for an industry thought to be a laggard.

51% embedded AI into a core customer-facing product. This doesn’t even include customer support. That means the initiatives were using AI to deliver their core product or service.

But only a handful had taken swings at category reimagination, business model transformation or solving problems created by AI. Here, we think, there’s room for new companies to take their place.

AI will favor the bold for new startups in fintech

In the AI era of financial services, the old startup trope of start small and then expand won’t cut it when competing with incumbents. The good news? Compressed development cycles mean founders can afford to be bolder from the very beginning. They can take the big swings where incumbents risk cannibalizing their own businesses, undermining their own business models and where completely new categories come to the fore as AI creates its own new set of problems.

1. Category Reimagination

AI offers the tools to reimagine the foundations of financial services — like brittle core banking systems, payment rails built for plastic not silicon, and the very services in financial services that can now be automated. Most incumbents won’t tear it all down to build it back up — they won’t risk dismantling the very businesses that have driven their success. Nor will they take the regulatory risks when they are already in the spotlight. There are exceptions, for example: Stripe has launched agentic payment tools like single-use virtual cards and payment link generation for AI agents, and Coinbase has introduced AgentKit to enable agents to perform on-chain operations. But even they have limits. AI-native startups, by contrast, can build from first principles — reimagining agentic commerce, autonomous finance, and AI-driven financial operations from the ground up.

2. Business Model Transformation

Fintech may be poised to be the leading business model of the agentic era. As LLMs supplant search, they challenge the ad-driven monetization model that’s dominated the web for decades. In an era where agents not only discover but transact, payments, lending and embedded financial services could become the native monetization rails. And in the same way that incumbents won’t blow up their existing businesses, they won’t be likely to blow up their existing business models either.

3. Solving AI-Created Problems

As AI systems become more powerful, they’re also creating new vulnerabilities. Fraudsters are now shipping features: synthetic identities, deepfake voice scams, and autonomous social engineering bots that operate at scale. Agentic systems introduce orchestration challenges: countless agents acting independently with partial context and no shared memory. And the authorization gap: no standardized way to determine which agent is allowed to move what money, on whose behalf, and under what conditions. These aren’t problems incumbents are optimized to solve within legacy systems — they’re net new infrastructure challenges.

These three categories offer a starting point for where bold founders can build in the agentic era. But there’s a twist: the moats that once protected the best startups don’t hold the same power anymore.

History Will Not Predict The Future When It Comes To Enduring Moats

In previous tech cycles, startup moats were built on things like: proprietary technology (now easier to replicate with open-source models and AI-assisted reverse engineering), speed and first-mover advantage (diminished by automation and radically shorter development cycles), technical hiring (AI enables smaller, less technical teams to achieve more), user scale advantages (less relevant when AI agents — not humans — are making decisions), and raw proprietary data (less powerful as foundation models generalize effectively across domains).

In the AI-native era, startups must build moats in areas that are harder to copy and rooted in human judgment, context, and systems thinking. Promising examples include:

1. An Emotionally Resonant & Trusted Brand

In the AI-native era, brand isn’t just a logo or a layer of polish — it’s how the product makes people feel. Trust, joy, confidence, familiarity. As users face a flood of faceless AI tools — especially in high-stakes categories like finance — brand becomes the clearest proxy for quality and alignment. It signals that someone is accountable. That there’s care behind the system. Startups can no longer wait to “earn” brand — they must design it from day one. It will be built not just through words, but through how the product looks, behaves, and earns trust with every interaction.

2. Interaction Experience

In AI-native products, interaction is where trust is earned — not just through clarity, but through judgment. The way a system asks for input, takes action, and communicates outcomes must feel aligned with user intent — even when that intent isn’t fully stated. This is especially critical in domains like financial services, where poor alignment erodes confidence fast. That kind of alignment mirrors how we trust people who know us well: we trust them to act with intuition, not just instruction. Recreating that feeling in software takes more than good UX — it demands human-crafted design, creative rigor, and a deep understanding of when to act and when to ask.

3. Tailored Expertise

In domains like finance, accuracy isn’t enough — users need to feel understood. The strongest AI-native products will combine deep domain expertise with personalized context to deliver answers that are not just correct, but specifically right for you. This isn’t general-purpose AI — it’s tuned to your situation, your constraints, your goals. When a system consistently delivers that kind of precision, it stops feeling like a tool and starts acting like a trusted advisor. That’s a moat.

4. System of Process

Owning the system of record used to be enough. In the AI-native era, the real moat comes from owning the system of process — the blueprint for how decisions get made, automated, and improved over time. In financial services and other complex operational domains, startups that combine the data layer, decision logic, and execution engine — and embed feedback into the loop — become deeply embedded. They’re not just a tool; they’re the infrastructure the business runs on. That’s hard to displace.

Illustrative Sectors Ripe For AI-Native Entrants

There’s room across sectors in financial services for category reimagination, fresh business models, and purpose-built solutions to the problems AI creates.

We’ve already seen a plethora of emerging activity across sectors, including:

Banking Tech:

Portfolio Company Example: Glide is modernizing financial institutions with an AI-powered platform designed for agility and automation.

CFO Stack & Financial Operations Automation:

Portfolio Company Example: Stream Claims is using GenAI to transform the workers’ comp experience — cutting friction, not just costs.

Capital Markets Tech:

Portfolio Company Example: Crux is using powerful software, embedded proprietary data, and AI to change the way clean energy and manufacturing projects are financed in the US.

Portfolio Company Example: Formulary is reimagining fund administration from the ground up as an AI-native operating system.

Below we deep dive into three more areas we think are increasingly ripe for new entrants.

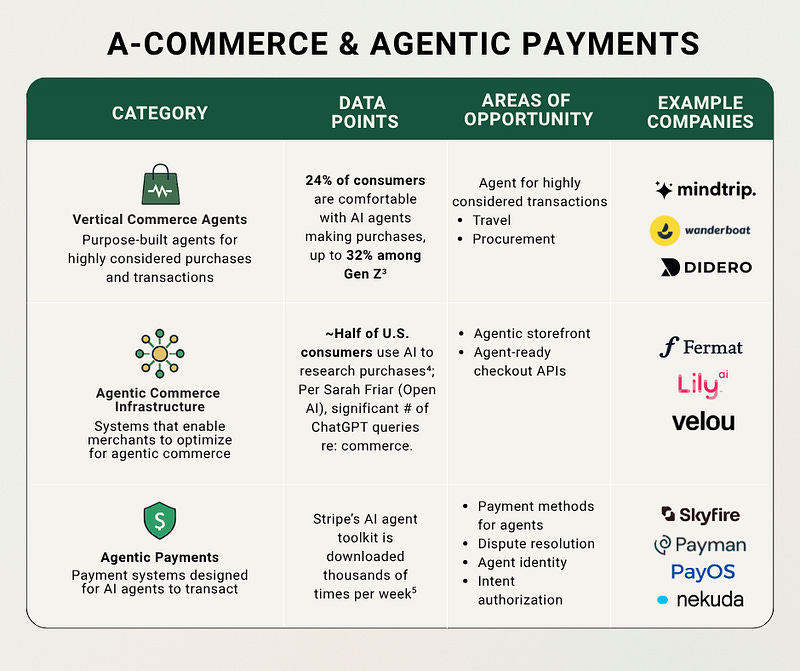

1: A-Commerce & Agentic Payments

Every major technological shift has transformed commerce and payments — unlocking opportunities to build generational companies. We’re now entering the era of agentic commerce — a category we at Acrew call a-commerce. This will be a full-stack reinvention of online transactions powered by agents. These agents will act on behalf of users to discover products, compare options, execute purchases, and manage post-sale tasks.

Some front footed incumbents are making real moves here as we discussed above (i.e. Stripe, Coinbase, Visa, Paypal). But these incumbents have to be mindful of conflicting businesses, eyes of regulators, etc. There’s room for bold startups to own a big share of this pie. Here are some categories of greatest interest:

For a more in depth overview on A-Commerce, check out our deep dive — A-Commerce Evolution: Agentic Commerce as The New Frontier.

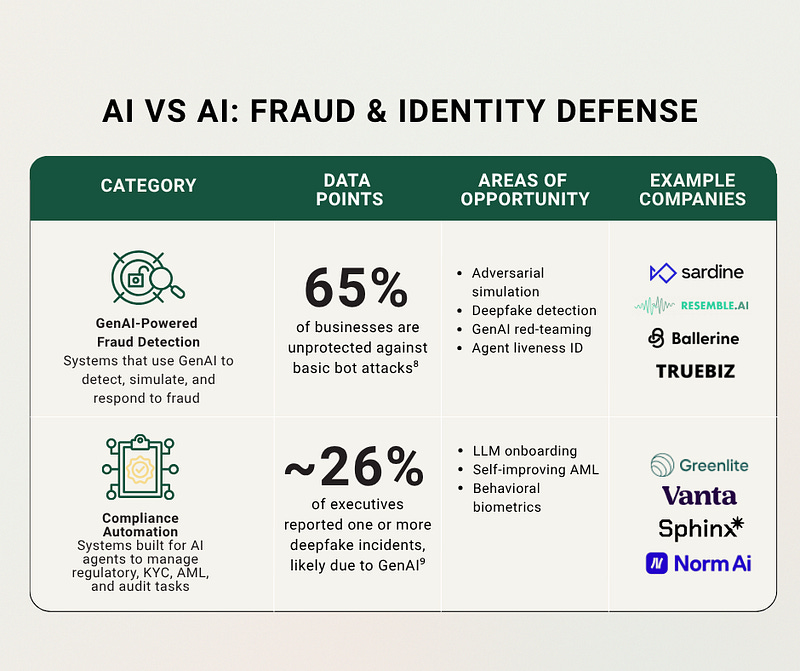

2: AI vs AI: Fraud & Identity Defense

AI doesn’t just create opportunity — it creates threat vectors. Combatting fraud and malicious actors is going to be an all out arms race. GenAI has already become a tool of innovation and exploitation for those who operate outside of the law.

Deepfakes now appear every five minutes⁶, and AI-driven fraud losses in the U.S. are projected to reach $40B by 2027.⁷ As fraudsters scale faster than incumbents can adapt, AI-native technologies — built to simulate, detect, and block AI-powered attacks — become paramount for financial security.

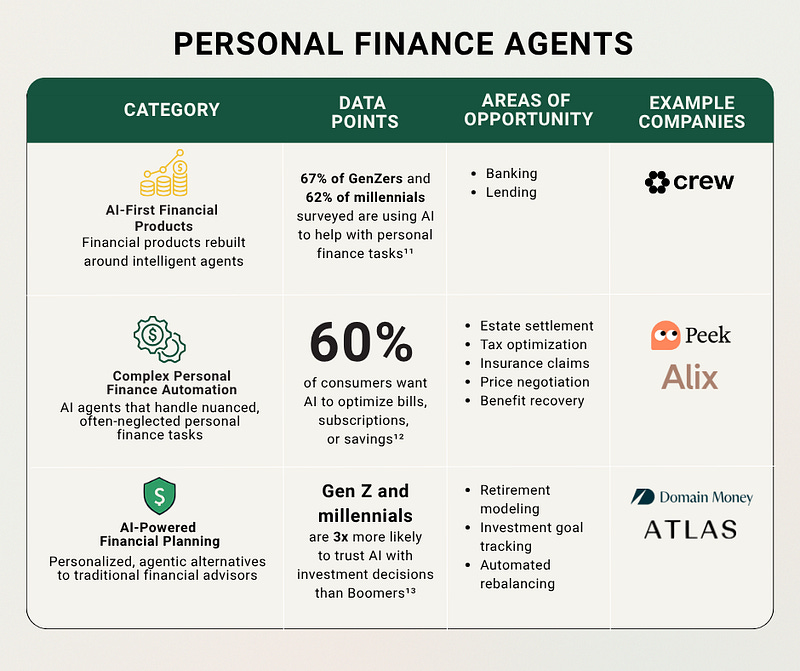

3: Personal Financial Agents

Still in its early innings, consumer fintech is about to go through its greatest transformation yet. While this may not be a popular opinion among my VC peers, all of the ingredients are in the water: a tech platform shift (obviously, AI); demographic shifts (Gen Z coming of age and the $11 trillion Boomer-to-Millennial wealth transfer)¹⁰; and macroeconomic shifts (ongoing macroeconomic volatility impacting consumer financial psyche).

A similar pattern powered the last breakout cohort of B2C and B2B2C fintechs that were born out of the Great Recession, as mobile became ubiquitous and millennials came of age. Think Block, Chime, Coinbase, Robinhood, Stripe, Square, etc. This isn’t a new idea for us — in fact, I wrote op-ed in Fortune about this a while back — but as AI comes into relative ubiquity the consumer opportunity comes to the fore.

Everything’s Changed — and It’s Still All About the Founders

Even as AI reshapes what’s possible, the companies that define this era will still be shaped by the people building them — because with the best founders, nothing else I’ve said really matters.

Founders who win in this era will uniquely have:

A clearly articulated view of their moat. The most enduring companies will be built by those with a sharp perspective on what makes them defensible — even if that view evolves. What matters is having clear thinking to anticipate where the edge could live, and the ability to think several moves ahead while others are still reacting.

A balance of conviction and agility. To build in this landscape, founders need strong belief in what they’re creating — enough to move with focus and speed. But they also need the humility to adapt. AI-native markets will shift under their feet, again and again, and only those willing to reimagine their product in real time will keep pace.

The ones who come out on top won’t just adapt to the AI era — they’ll tear it down and rebuild financial services from the ground up.

¹ American Banker: 80% of Wall Street firms are splurging on AI: Broadridge (April 2025)

² Global Newswire: Artificial Intelligence (AI) in Fintech Business Research Report 2024: Global Market to Grow by $56.9 Billion by 2030 with AWS, Complyadvantage, Google, IBM, Inbenta at the Forefront (November 2024)

³ Salesforce: Consumers Are Ready for AI Agents. Are Businesses? (April 14, 2025)

⁴ Yahoo!Finance: Nearly half of US consumers use AI tools when shopping online, study finds (April 4, 2025)

⁵ FF News: Stripe’s Total Payment Volume Reaches $1.4t as Long-Standing Investments in AI Pay Off (June 3, 2024)

⁶ Entrust: Deepfake Attempts Occur Every Five Minutes Amid 244% Surge in Digital Document Forgeries (November 2024)

⁷ Deloitte: Generative AI is expected to magnify the risk of deepfakes and other fraud in banking (May 2024)

⁸ DataDome: How AI Is Used in Fraud Detection (March 21, 2025)

⁹ Deloitte: Generative AI and the fight for trust (May 2024)

¹⁰ Yahoo!Finance: How Millennials Could Get Rich During the Great Wealth Transfer (December 13, 2024)

¹¹ Experian: Americans are embracing Gen AI to make smart money moves (October 24, 2024)

¹² Ibid

¹³ World Economic Forum: New research finds retail investing shift towards younger investors, reshaping market trends (March 25, 2025)