Biomanufacturing in an AI-Native World

Driving 10X+ improvements in time and cost efficiency

By Kunaal Patel and the Acrew Capital team

Executive Summary

Biologic manufacturing, from monoclonal antibodies to vaccines, relies on living cells to produce complex therapeutic proteins. Small variations in upstream cell culture or downstream purification can derail safety, potency, and quality, turning what should be routine batches into costly failures. The handoff from development to production (tech transfer) and the systematic scale-up from lab to commercial volumes remains a 12+-month bottleneck. Each failed batch not only delays patient access but also incurs millions in disposal, root cause analysis, and rework costs.

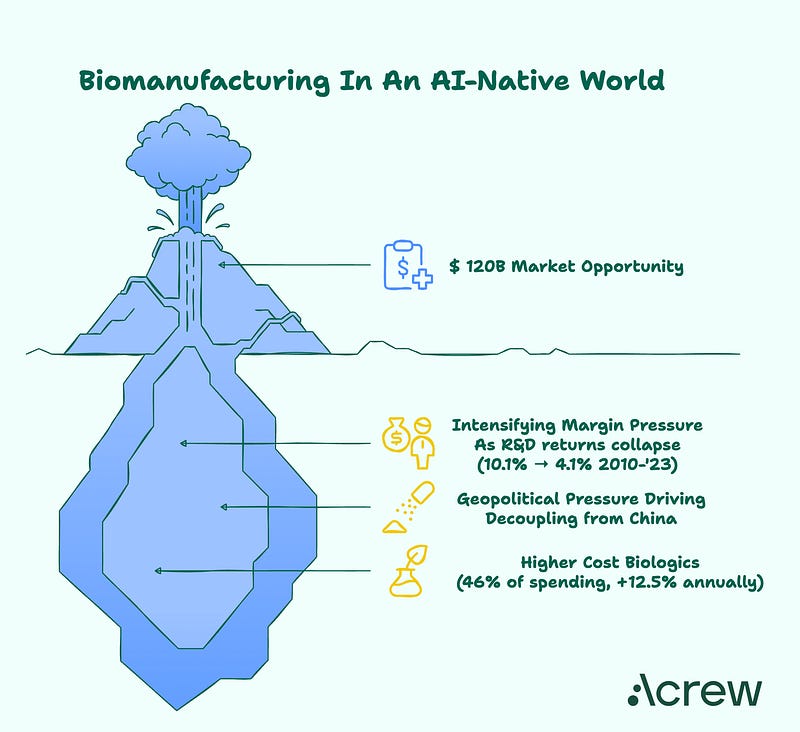

With over $120 billion spent annually on biologics manufacturing, there is an urgent need for smarter, faster, and more predictable processes. AI-enabled platforms that automate tech transfer protocols and predict batch failures promise to modernize this pipeline — offering the potential to reduce timelines by an order of magnitude and significantly cut operational expenses.

Why AI? The latest wave of deep learning methods, namely LLMs, have transformed the field two-fold:

Compute. Parameter scaling has provided computational power to ingest, clean, and model multivariate unstructured + structured data at a scale that hasn’t been possible before.

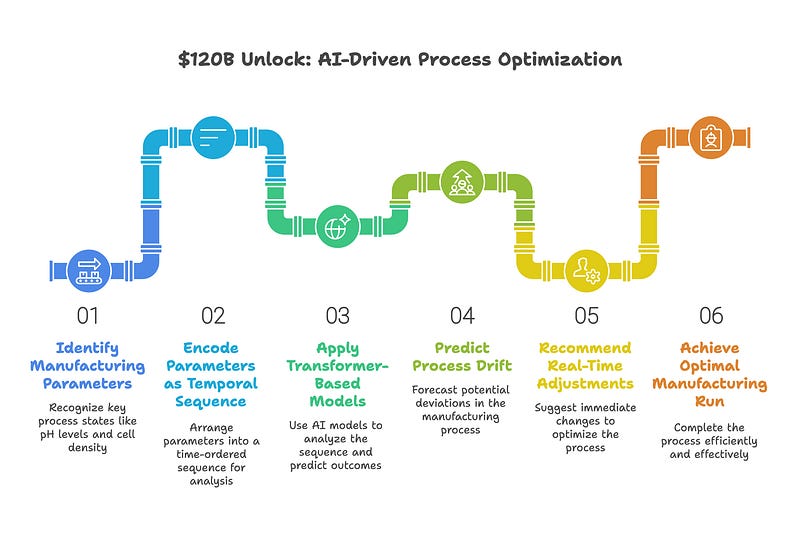

Next Token Prediction. In practical terms, each “token” represents a discrete state in the manufacturing process such as pH level at a given timepoint, dissolved oxygen reading, impeller speed, cell density, or nutrient concentration profile. By encoding these parameters as a temporal sequence, transformer-based models can learn the probabilistic relationships between states and use next-token prediction to forecast process drift, anticipate deviations, and recommend real-time adjustments. This approach effectively “auto-completes” the optimal manufacturing run.

We believe AI-enabled process optimization/improvement platforms focusing on tech transfer automation and batch failure prediction represent a compelling opportunity to modernize biomanufacturing with potential for 10X+ improvements in both time and cost efficiency.

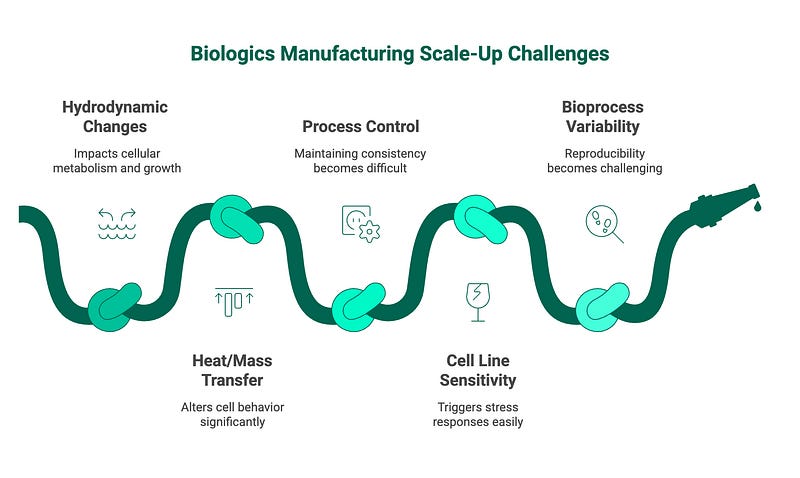

The Problem: Fundamental Scale-Up Challenges

Biologics manufacturing scale-up represents a critical “valley of death” in the $448.1 billion biopharmaceutical market where promising therapies often fail due to manufacturing challenges rather than efficacy or safety concerns. Unlike small molecule drugs, biologics are produced in living systems that introduce immense complexity when scaling from laboratory (5–10L) to commercial production (2,000–20,000L). The economic stakes are enormous — facilities cost $200–500 million to build, each halving of production volume increases unit costs and batch failure rates during early scale-up attempts:

Hydrodynamic Changes: As bioreactor volume increases, mixing patterns, shear stress, and gas transfer dynamics change dramatically. These physical changes directly impact cellular metabolism, growth rates, and protein expression.

Heat and Mass Transfer Issues: Larger vessels have different surface-to-volume ratios, leading to changes in heat dissipation and nutrient/oxygen distribution profiles that can significantly alter cell behavior

Process Control Complexity: Maintaining consistent pH, dissolved oxygen, temperature, and nutrient levels becomes exponentially more difficult as scale increases

Cell Line Sensitivity: Mammalian cell lines used for biologics production are extraordinarily sensitive to environmental conditions, with even minor deviations potentially triggering stress responses that alter protein structure or quality

Bioprocess Variability: Living systems exhibit inherent biological variability that becomes magnified during scale-up, making process reproducibility exceptionally challenging

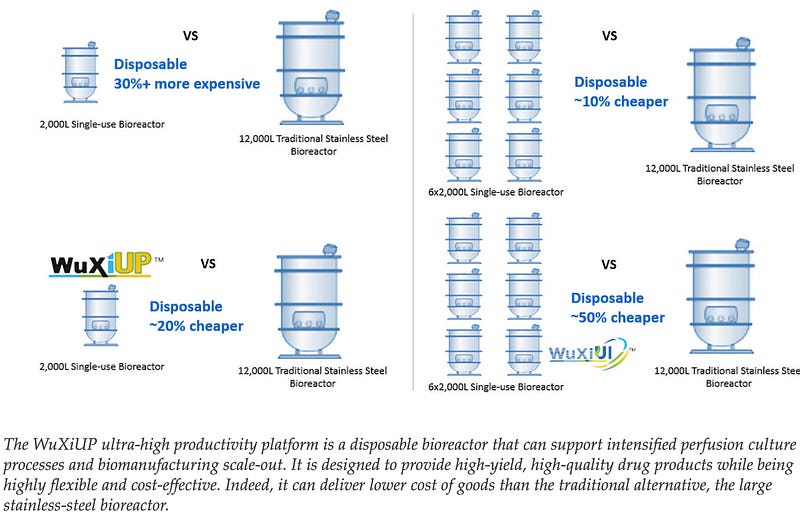

This Leads To Best Practices That Are Inefficient & Do Not Scale…Traditional biologics scale-up follows a linear approach with discrete steps between laboratory, pilot, and commercial scales, creating multiple process transfer points where failures commonly occur. Each transfer requires extensive empirical testing with limited predictive capabilities, resulting in tech transfer and process validation timelines of 12–24 months. Process parameters that work at small scale often fail to translate directly to larger vessels due to changes in mixing dynamics, oxygen transfer, and heat dissipation. Current approaches rely heavily on trial-and-error experimentation and the expertise of a limited pool of skilled scientists, with minimal real-time feedback during critical scaling decisions. CDMOs have started to adopt ‘Scale out’ methods to reduce costs with disposable bioreactors but this neither solves the tech transfer → production issue nor provides economies scale as these lines must scale linearly with production volume.

These traditional methods contribute to the high failure rates & extended timelines that plague biologics manufacturing.

Manufacturing Costs Drive A $120B+ Market Opportunity…

The biopharma manufacturing segment represents approximately ~$120B+ (assuming 23.5% margin for manufacturing costs; $511B biologic market) in manufacturing costs across biologics.

Contract manufacturing specifically is experiencing rapid growth, with the global biopharma contract manufacturing market valued at $40.1 billion in 2024 and projected to grow at a CAGR of 11.1% through 2030 (Grand View Research, 2024.)

So Why Now? Macro Forces Driving Urgency…

Three significant macro forces have converged to create an unprecedented window of opportunity for innovation in biopharmaceutical manufacturing:

1. Intensifying Margin Pressure on Pharma

The industry faces unprecedented margin pressure, with R&D costs rising while returns decline sharply:

Rising development costs: The average cost to develop a new drug has increased to over $2.23 billion in 2024, while the average return on R&D investment has fallen from 10.1% in 2010 to just 4.1% in 2023 (Deloitte, 2024; Reuters, 2018)

Patent cliff acceleration: Major pharmaceutical companies face patent expirations on drugs representing $236 billion in sales between 2024–2030, creating urgent need for manufacturing efficiency

Pricing pressures: The Inflation Reduction Act’s Medicare drug price negotiation provisions are expected to reduce pharmaceutical revenues by $96 billion through 2030, driving companies to find cost efficiencies to protect margin

2. Policy & Geopolitical Pressure Driving ‘Nearing-shoring’

The Biosecure Act has prohibited pharma from contracting with “biotechnology companies of concern,” primarily from China, with a 2032 deadline for U.S. pharma companies to sever ties with listed Chinese entities. We have already seen signs of decoupling via Wuxi Apptec’s divestiture of their US/UK CGT therapy business, which may lead to net new supply chains in the coming years

Geopolitical Risk: ~17% of API the US imports comes from China. Additionally, China supplies India — the US’ fifth largest source of pharmaceutical imports — with nearly 70% of its APIs

The vulnerability of extended global supply chains, combined with intensifying geopolitical tensions, has created urgency for pharmaceutical companies to develop more resilient, localized, and efficient manufacturing capabilities.

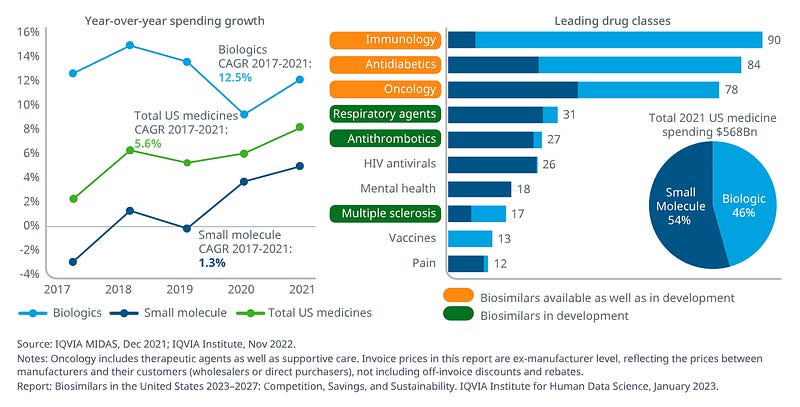

3. Shift Toward Higher Cost Biologics

The pharma pipeline is increasingly dominated by complex biologics that present unique manufacturing challenges:

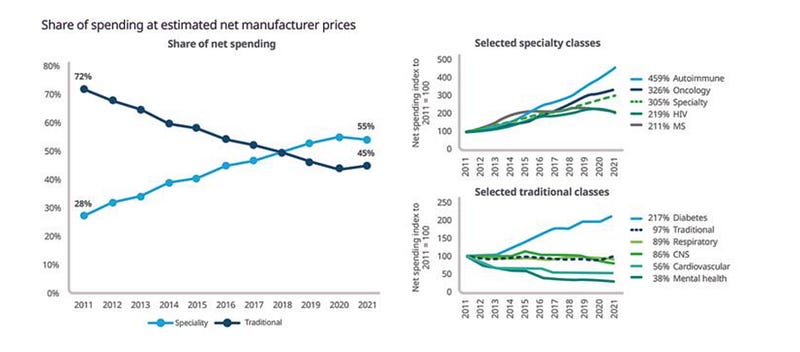

Rising market share: Biologics now comprise 46% of total medicine spending in the U.S., growing at 12.5% annually, significantly faster than small molecules (IQVIA, 2023)

Manufacturing complexity: Biologics require specialized facilities and expertise, with production costs 10–20x higher than small molecules due to their size (200–1000x larger than small molecules) and complex structure.

Small batch production: Unlike mass-produced small molecules, biologics typically require smaller, more specialized production runs and precision manufacturing techniques, with stringent temperature and environmental controls

High-value specialized products: Specialty medicines accounted for 55% of net spending in 2022, up from 28% in 2011, with continued growth driven primarily by autoimmune and oncology therapies (IQVIA, 2023)

This shift requires fundamental changes to manufacturing approaches, moving from traditional batch processes optimized for high-volume production to flexible, precise processes capable of handling complex biomolecules in smaller, highly controlled environments.

Convergence Point

The confluence of these three macro forces — margin pressure, Policy and Geopolitical shifts, and the rise of biologics — has created an unprecedented window of opportunity for innovation in manufacturing. At the forefront AI (process optimization, cell expression modeling, metabolic pathway modeling etc.) and Robotics (dark factories, continuous manufacturing etc.) provide immediate utility to solve this issue.

What Could Be The Winning Formula For This Space?

AI-enabled manufacturing systems can transform biologics scale-up by addressing the core challenges of predictability, reproducibility, and process optimization.

AI-enabled platforms that address immediate pain points in tech transfer automation and batch failure prediction, where ROI can be immediately quantified. A key gating factor is data access, especially failed batch data, which is often siloed, incomplete, or commercially sensitive.

Startups will need to overcome the “cold start” problem through early design partnerships with CDMOs or pharma, creative use of synthetic data, transfer learning from adjacent processes, and leveraging any regulatory pathways that mandate data sharing. While life sciences data generation continues to grow exponentially to the exabyte level, customers are still struggling to turn process data into actionable insight. This creates a large opportunity for platforms that can both operate at the application layer and build proprietary datasets over time.GTM: Improve vs. Net New. Design partnerships with pharma/CDMOs to start with process optimization (improve existing workflows) before process improvement (net new workflows)

Solutions that demonstrate measurable economic impact through pilot projects (e.g., >$1M in direct cost savings, >10% throughput improvements, or >30% reduction in process development time)

Founding teams with complementary background in both biomanufacturing ops and AI/software dev, with an emphasis on connections to CDMOs and pharma manufacturing teams (to hack GTM)

Companies that can address multiple therapeutic modalities within biologics, such as monoclonal antibodies, recombinant proteins, mRNA vaccines, and cell or gene therapies. Platforms that can adapt to the varying manufacturing requirements, process controls, and quality attributes of these modalities will be better positioned to capture share across the fastest-growing and most complex segments of the market.

Companies with strong ‘simulation’ capabilities that enable virtual process experimentation (digital twins) and simulation before physical implementation, as they offer significant risk reduction and cost-saving benefits to manufacturers

Value technology differentiation through hardware-software integration, particularly in solutions that combine specialized hardware automation with proprietary AI models that get better a function of their proprietary data generation flywheel

Positioning against incumbents is critical. Existing manufacturing execution systems (MES) and process analytical technology (PAT) tools from incumbents such as Emerson, Siemens, and Sartorius are often rigid, hardware-tied, and poorly integrated with modern AI workflows. They excel at compliance and monitoring but lack predictive capability, cross-process learning, and the ability to incorporate unstructured data such as lab notes or image-based QC results. This creates clear whitespace for nimble players who can layer intelligence on top of existing infrastructure without forcing costly system overhauls.

The biopharma manufacturing scale-up process represents a significant opportunity for technology-enabled disruption. While the market has been historically conservative in adopting new approaches, economic pressures and competition for manufacturing capacity are driving unprecedented openness to innovation.

Fortune favors the bold.

If you’re building or operating in this space let’s connect: kp@acrewcapital.com