All in on AI, the first Financial Services AI Adoption Index by Acrew Capital & Money2020

FinTech is dead — or so everybody keeps telling me. They point to FinTech investors fleeing like rats from a sinking ship as evidence. I see those investors fleeing too. I also saw them jump aboard when the going was good. That’s the thing about tourists — they come when the weather is nice and leave before the rainy season.

FinTech is in its rainy season. It’s taken a meaningful hit and hasn’t bounced back the way other industries have. I think there’s a real reason for that: Tech hasn’t reinvented financial services yet. There have been few efficiency gains and not nearly enough innovation. It’s a highly regulated industry, so I understand why.

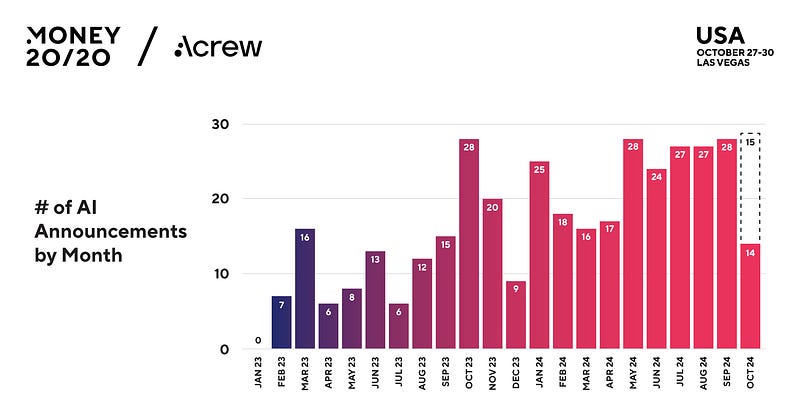

But over the last year, I’ve had a sneaking suspicion that AI might be the forcing function for financial services to reinvent itself.

Until recently, that suspicion wasn’t supported by data.

Today, that changes.

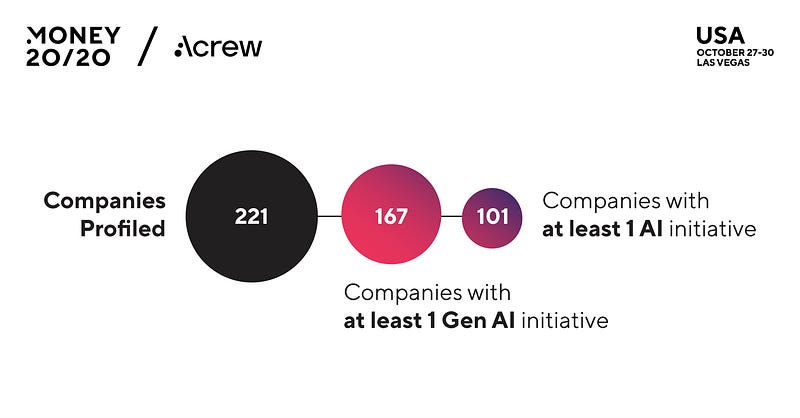

At Acrew Capital, we partnered with Money 2020 to create the Financial Services AI Adoption Index — a massive undertaking profiling 221 companies and analyzing 376 AI initiatives.

Through our analysis, patterns began to emerge. For the first time, we gained insight into not only what financial services are currently doing with AI, but where the gaps are and where new AI-native startups could step in to meet unfulfilled needs.

The numbers tell a compelling story but it’s the conversations we had while building this report that make me feel more bullish than ever.

Aliisa Rosenthal, Head of Sales at Open AI told us that “when we launched ChatGPT Enterprise… our first customers were largely Financial Services.”

I’m excited by the massive opportunities we uncovered. I think you will be too. Maybe we can finally put the “FinTech is dead” narrative to rest once and for all. If this report is any indication, FinTech’s finest hours lie ahead.